STRATEGY 2025 - 2030

DN AGRAR Group S.A., a recognized leader in the European agricultural sector, is proud to announce its bold new strategy for the next decade.

As we look toward 2030, our commitment to growth, innovation, and sustainability is stronger than ever. This strategy is designed to not only position us as a forward-thinking industry leader but also to deliver exceptional value to our investors, partners, employees and other stakeholders.

As the agricultural landscape rapidly evolves—driven by technological advancements, climate challenges, and shifting consumer needs—DN AGRAR Group S.A. is taking decisive steps to stay ahead of the curve. Our new strategic vision leverages decades of expertise while addressing the needs and opportunities of the future.

Our strategy for 2030 is underpinned by FIVE CORE PILLARS:

1. sustainability

Our goal is to enhance local production capabilities, reduce food shortages, and ensure more people have access to high-quality, nutritious, locally-produced food.

Sustainable food production remains a cornerstone of our strategy. With food security challenges intensifying, particularly in regions facing local food deficits, we are doubling down on our efforts to drive sustainable and efficient agricultural practices.

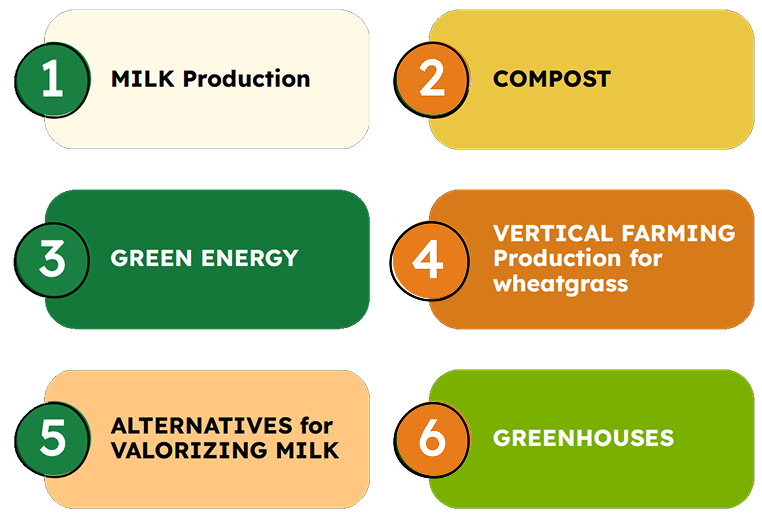

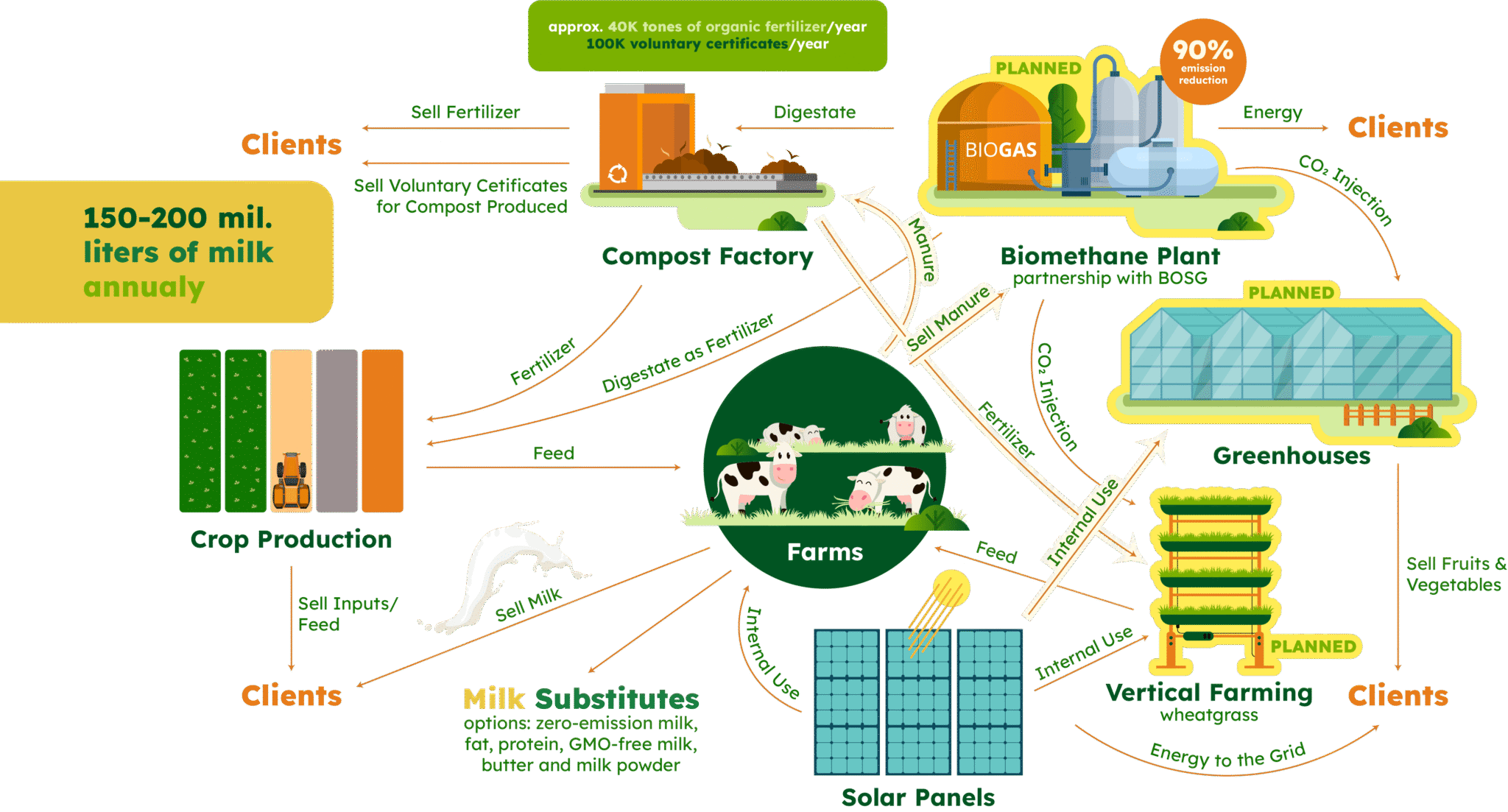

2. diversification

We are focused on diversifying our business lines to tap into new markets, maximize efficiencies, and create a more resilient business model.

This diversification will open new growth avenues, increase our competitiveness, and strengthen our position across the entire agri-food value chain.

4. expansion of current business lines

DN AGRAR plans to discover trough market studies and analyses expansion into markets like Hungary, Poland, and Bulgaria, where demand for high-quality dairy products and fruit and vegetable production is growing rapidly.

3. cost optimization via: digital & automation transformation

A key component of our strategy is the creation of industrial clusters for sustainable food production.

By integrating complementary production facilities, we will optimize supply chains, reduce waste, and maximize efficiency across our operations.

These clusters will not only streamline our processes but also foster synergies between our business lines, making our operations more effective, sustainable, and resilient.

By leveraging these synergies, we will create a robust ecosystem that enhances productivity while minimizing environmental impact, driving greater long-term value.

2. diversification

We are focused on diversifying our business lines to tap into new markets, maximize efficiencies, and create a more resilient business model.

This diversification will open new growth avenues, increase our competitiveness, and strengthen our position across the entire agri-food value chain.

3. cost optimization via: digital & automation transformation

A key component of our strategy is the creation of industrial clusters for sustainable food production.

By integrating complementary production facilities, we will optimize supply chains, reduce waste, and maximize efficiency across our operations.

These clusters will not only streamline our processes but also foster synergies between our business lines, making our operations more effective, sustainable, and resilient.

By leveraging these synergies, we will create a robust ecosystem that enhances productivity while minimizing environmental impact, driving greater long-term value.

4. expansion of current business lines

DN AGRAR plans to discover trough market studies and analyses expansion into markets like Hungary, Poland, and Bulgaria, where demand for high-quality dairy products and fruit and vegetable production is growing rapidly.

5. value creation for our investors

For our investors, this strategy is about delivering superior returns through operational excellence, strategic market expansion, and a focus on high-growth, sustainable opportunities.

Agriculture investment made simple, profitable and sustainable.

As we execute this strategy, we are positioning DN AGRAR Group S.A. for strong financial performance that will generate long-term value.

A critical milestone in this journey is our planned upgrade to the Main Market of the Bucharest Stock Exchange.

This move will elevate our visibility, enhance liquidity, and provide the capital necessary to fuel growth, making us an even more attractive investment proposition.

SWOT Analysis

A SWOT analysis is a strategic planning tool used to identify and evaluate the Strengths, Weaknesses, Opportunities, and Threats related to a business, project, or individual. It helps in decision-making by providing a clear overview of internal and external factors that can impact success.

STRENGHTS

– Integrated Agribusiness Model

– Strong position in the Romanian dairy market

– Technological Leadership

– Strategic Access to EU Funds

– Robust Strategic Roadmap

WEAKNESSES

– Geographic Concentration Risk

– High Capital Intensity

– Dependency on EU Subsidies

– Limited Consumer Brand Recognition

– Labor and Workforce Challenges

OPPORTUNITIES

– Rising Demand for Sustainable Dairy and Traceable Food Sources

– Expansion into Value-Added Commodity

– Land Value Appreciation and Strategic Acquisitions

– Carbon Credit and Circular Economy Opportunities

– Digital Transformation and Smart Farming

– High-Value Greenhouse & Vertical Farming

– Expansion in the Region

– Food Deficit

– Farm to Fork

THREATS

– Geographic Concentration Risk

– High Capital Intensity

– Dependency on EU Subsidies

– Limited Consumer Brand Recognition

– Labor and Workforce Challenges

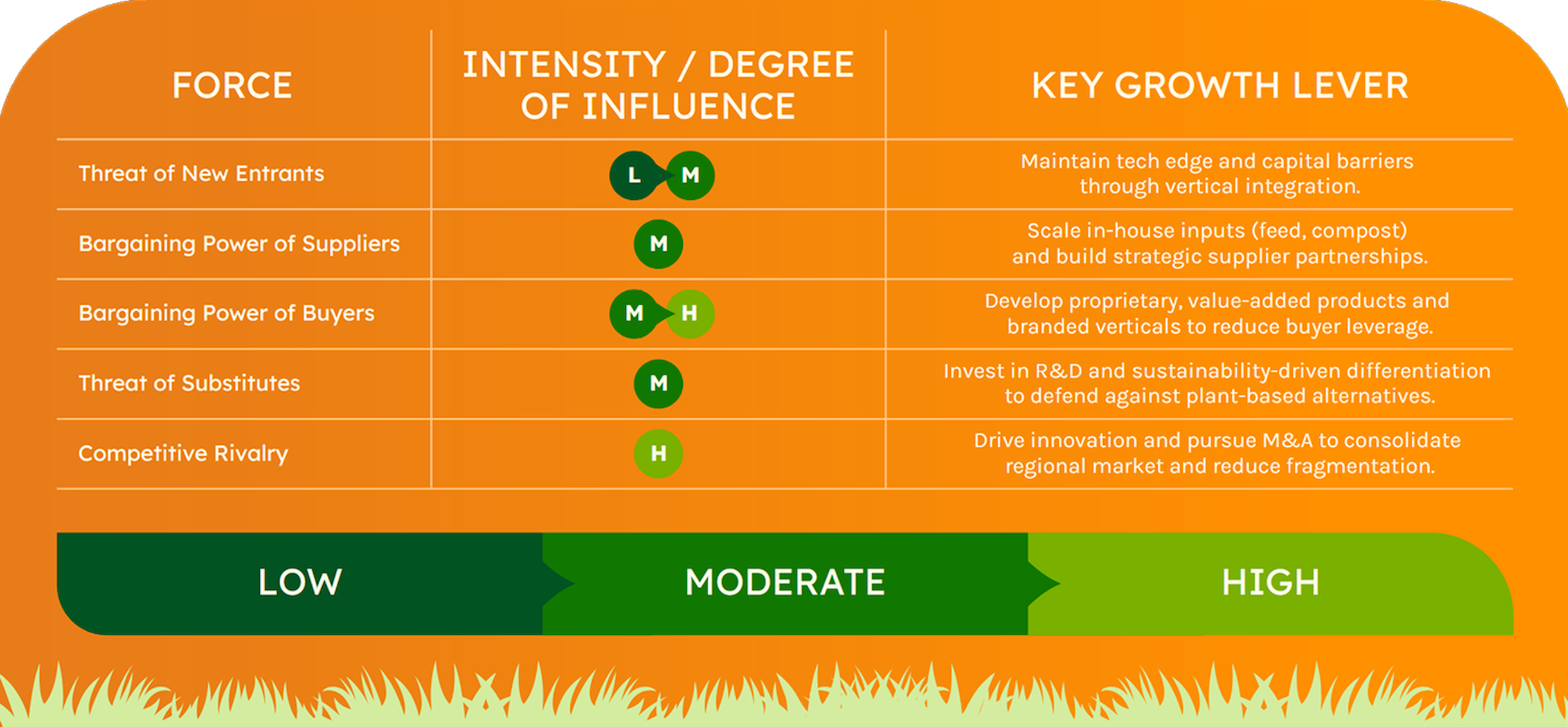

Porter’s Five Forces Analysis

Porter’s Five Forces Analysis is a strategic framework used to evaluate the competitiveness of an industry and its potential profitability. It examines five key forces: the intensity of competition among existing firms, the threat of new entrants into the market, the bargaining power of suppliers, the bargaining power of buyers, and the threat of substitute products or services. Together, these forces help businesses understand the structure of their industry and identify strategic opportunities or threats.

Business

Segments

Milk Production

Investment in CUT 2 Farm

We are launching the CUT 2 Farm, a state-of-the-art dairy facility with a capacity of 5,000 cows and a daily milk production of 150,000 liters.

The farm will feature two state-of-the-art milking rotors, facilitating three milking sessions per day for optimal milk yield. Additionally, robotic systems will be installed in the milking parlors for automated udder dipping and cleaning, ensuring the highest standards of hygiene and animal welfare.

estimated investment:

Approx. EUR 13-15mil

financing:

Bank loan (EUR 10mil)

and own sources

Research & Development for Straja 2 Farm

The Straja 2 Farm is an ambitious project within DN AGRAR Group, aimed at establishing a high-tech, sustainable dairy farm with the capacity to house 5,000 dairy cows and produce 150,000 liters of milk per day.

An integral component of the plan will also involve a compost factory for converting waste from both farms into organic fertilizers, further promoting a circular economy and reducing operational costs.

Straja 1 Farm Status

Operations started in March 2025.

The goal is to reach a herd of 1,800 cows by the end of 2025. By 2026, the farm expects to have approximately 3,400 animals.

The project is set to be fully completed and operational by the end of 2027, with a herd of 5,000 animals and a daily production of 150,000 liters of milk. For Straja farm is planned also the installation of robots, in order to optimize processes.

Expanding milk production capacity at the APOLD Farm

The goal is to reach a herd of 1,800 cows by the end of 2025. By 2026, the farm expects to have approximately 3,400 animals. The project is set to be fully completed and operational by the end of 2027, with a herd of 5,000 animals and a daily production of 150,000 liters of milk. For Straja farm is planned also the installation of robots, in order to optimize processes.

Compost

Transforming organic waste into premium organic fertilizers

In line with our commitment to sustainability, DN AGRAR will invest in multiple compost factories, transforming organic waste into premium organic fertilizers. This circular economy approach will not only reduce waste but also create a new, high-margin revenue stream, contributing to the overall value proposition of the Group.

Units developing:

4 new compost factories

Decisions to be made:

Adding 2 more units in 2030 (Straja Farm)

DN AGRAR's Carbon Reduction and Compost Certification Strategy

At DN AGRAR, we are committed to reducing our carbon footprint through sustainable practices such as composting and no-till farming.

We are in the process of acquiring voluntary carbon certificates, aiming to generate 100,000 certificates annually over the next 15 years, with each compost facility contributing approximately 16,000 certificates per year.

To enhance our efforts, we are pursuing Gold Standard certification and establishing a dedicated sales channel for these credits.

In parallel, we are certifying the organic compost produced at our facilities, with a total projected annual output of 42,000 tons.

To support direct B2C sales, we plan to equip each compost facility with sorting and packaging lines (investing €60,000–€70,000 per unit), enabling us to offer compost in 5, 10, and 15-liter bags.

Our overarching goal is to become a leader in sustainable agriculture, significantly reducing emissions while generating new revenue streams.

Green Energy

DN AGRAR Group Leads Romania’s Biomethane Revolution

DN AGRAR Group, Romania’s largest integrated livestock farm and top milk producer, is taking a major step toward sustainability with a strategic investment in biomethane production.

In partnership with BSOG Energy (Black Sea Oil & Gas), DN AGRAR plans to develop Romania’s largest biomethane facility, with an initial production capacity of up to 15 MW and the potential to expand to over 20 MW.

Turnover:

Completion

Timeline:

€3.5-4 million/year

Within 2 years of the final agreement

Solar Panels on the Rooftops of Farms

DN AGRAR’s solar panel project is a cornerstone of the company’s comprehensive strategy to enhance its sustainability and achieve, as much as possible, energy independence for its farms.

DN AGRAR plans to install solar panels on the rooftops of its farms and facilities buildings with the primary goal of reducing its carbon footprint and securing a renewable energy source for its internal operations.

With this initiative, DN AGRAR aims to reduce with 80% the electricity power bills, which translates to:

2026

Estimated cost reduction: ~ EUR 500K

(solar panels on Apold, Cut, Lacto Agrar farms)

2027

Estimated cost reduction: ~ EUR 700K

(solar panels on Apold, Cut, Lacto Agrar, Straja farms)

2028

Estimated cost reduction: ~ EUR 900K

(solar panels on Apold, Cut, Lacto Agrar, Straja, Cut 2 farms)

Vertical Farming

Investment plan:

Sustainable Wheatgrass Production for Livestock Feed at DN AGRAR Group

DN AGRAR Group is positioned to lead the next frontier in sustainable farming with the integration of vertical farming for wheatgrass production, utilizing CO₂ captured from the Biomethane plant.

This innovative solution will enable the production of 40 tons of wheatgrass daily, with the possibility of replacing 25% of the current feedstock.

The vertical farming system offers multiple advantages, including consistent, high-yield production, water efficiency, and land conservation.

Estimated investment:

Between EUR 3-4 million

for 20 tons produced

Financing:

Bank loan

ROI:

Approx. 3 years

For DN AGRAR, this project is an opportunity to capitalize on cutting-edge technology while enhancing sustainability, lowering costs, and improving the health and productivity of livestock.

Why Wheatgrass for Livestock Feed?

Nutritional Profile for Livestock:

Wheatgrass is packed with essential nutrients—vitamins, amino acids, antioxidants, and minerals, constant high level of protein—which contribute to better animal health and higher productivity.

Healthier cows are more productive, with improved milk yields and growth rates, ultimately leading to higher profitability.

Healthier Cows, Better Yields:

Wheatgrass supports better digestion and nutrient absorption, boosting the immune system and reducing the likelihood of diseases.

Cows fed on wheatgrass are healthier and less reliant on veterinary care, reducing operational costs and improving overall profitability.

Improved Milk Quality:

Wheatgrass has been shown to improve the quality of milk, offering nutritional benefits to consumers. This can be a marketable differentiator in an increasingly health-conscious food market

Efficient Feed Conversion:

Wheatgrass is easily digestible, meaning cows can extract more nutrients and convert them into energy efficiently. This leads to better feed-to-product ratios, reducing the overall cost of feed per unit of milk.

Happy cows

Healthy milk

Satisfied customers

Resilient Food Supply:

With protected, controlled environments, vertical farming ensures consistent year-round production of high-quality feed, mitigating the risks posed by climate change or unpredictable weather patterns that often disrupt traditional crop farming.

Alternatives for Valorizing Milk

Increasing the Value of Raw Milk

We are conducting in-depth research on methods to increase the value of raw milk, including developing premium dairy products such as cream, fat and milk powder.

This focus on value-added products will allow us to capture premium pricing, increase margins and diversify into higher-value sectors, creating new revenue opportunities in both local and international markets.

Research Key Objectives:

• Milk Valorization and Value-Added Products

• Market Expansion and Client Diversification

• Environmental Impact and Circular Economy Practices

Greenhouses

Greenhouse vegetable cultivation presents a transformative growth opportunity for DN AGRAR.

With Romania’s current dependence on imports, a shrinking open-field production base, and soaring demand for fresh, year-round produce, greenhouse farming offers an attractive, subsidy-backed path to diversify operations.

While the entire vegetable category is relevant, leafy vegetables and brassicas stand out as particularly strategic due to their high import reliance, price volatility, and sensitivity to climate exposure.

Why?

Because the market context & structural gaps offer opportunities.

• Total vegetable production in Romania fell from its peak in 2021, driven by decreasing field yields and weather vulnerability.

• Vegetable consumption in Romania reached 8.72 kg/person/month in 2023—an all-time high.

• Romania cultivates only ~10% of vegetables under cover, representing roughly 4,600 ha—well below regional benchmarks such as Poland (~5,220 ha).

• The country’s leafy vegetable and brassica output is also modest and declining, while consumer demand remains strong and rising.

• Romania is a net importer of vegetables, particularly in the winter and early spring seasons. Key imports include lettuce, tomatoes, cucumbers, and brassicas—products that perform well in greenhouses.

• Strategic priorities for Romania include boosting yield efficiency, investing in protected cultivation, and targeting high-value crops to improve trade balance and reduce import reliance.

STRATEGIC IMPACT

Reduce Romania’s dependence on imports during off-season

Deliver premium pricing and high yield per m²

Diversify DN AGRAR’s revenue beyond milk

Contribute to sustainability, composting, and ESG metrics

Position the company as a first-mover in protected vegetable farming in Romania

In 2028, we plan to start construction of the first greenhouse

The start of operations is anticipated in 2030

STRATEGIC TIMELINE 2025 - 2030

An integrated Business Model

DN AGRAR in 2030:

Resilient.

Profitable.

Sustainable.

Ready for the future.

Working Scenarios:

What’s included in the financial scenarios up to 2030:

• Current operations

• Straja farm

• Cut 2 farm

• 28,000 tons organic fertilizer

• Biometehane production (from 2028)

• Solar in Straja, Apold, Cut and Lacto

What’s not included in the scenarios, will be included in the coming years when all details are known:

• Straja 2

• 14,000 tons of organic fertilizer

• 2 greenhouses for vegetables production

• Solar in Cut 2 and Straja 2

• Wheatgrass production ass feedstock for animals

• Different valorization of the commodity milk

• Approximately 100,000 voluntary carbon certificates annually for a period of 15 years, with a current value of approximately Euro 20 per certificate

• Certificates obtained due to the implementation of no-till

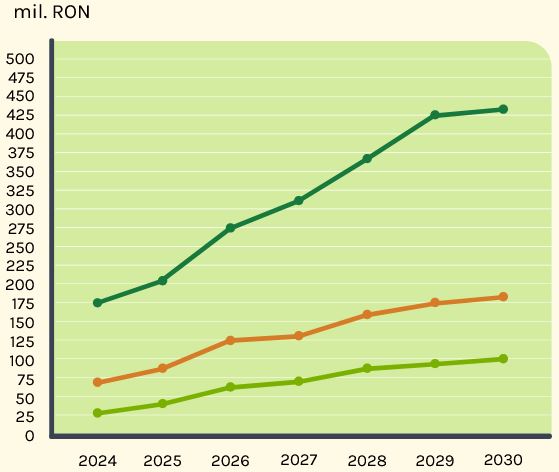

SCENARIO 1

In scenario 1, the milk price is considered based on the average milk price in 2023.

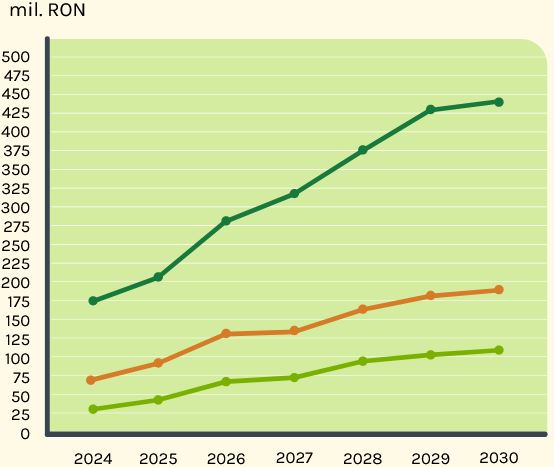

SCENARIO 2

In scenario 2, the milk price is considered based on the average milk price in 2024.

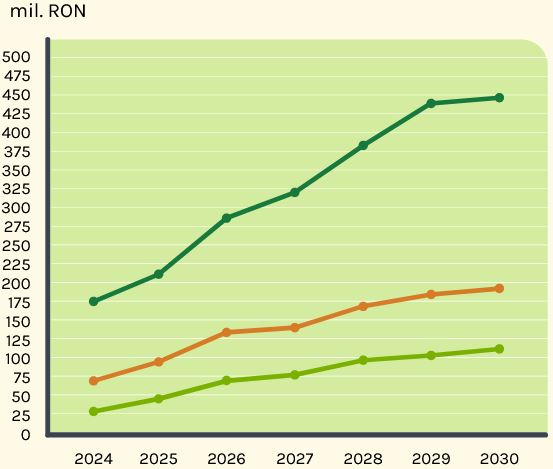

SCENARIO 3

In scenario 3, the milk price is considered based on the average milk price at the end of 2024.

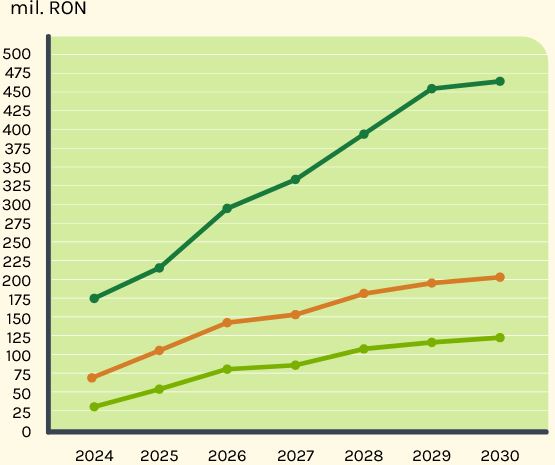

SCENARIO 4

In scenario 4, the milk price is considered based on the average milk price in 2025, until now.

MAIN MARKET & Dividends

Strategic Roadmap for Main Market

DN AGRAR, a high-growth agricultural company that was successfully listed on the Bucharest Stock Exchange in 2022, is pleased to announce its strategic roadmap towards upgrading to the Main Market in the coming years.

Our objective is to adopt IFRS reporting starting in 2026.

Dividend Plans

In addition to dividends, DN AGRAR is considering the implementation of a share buyback program in the coming years, as well as the possibility of allocating free shares to shareholders. These initiatives aim to further increase shareholder value, strengthen investor confidence, and improve capital market visibility—without constraining the company’s ambitious strategic objectives through 2030. These measures will be evaluated carefully to ensure alignment with DN AGRAR’s commitment to sustainable growth, financial discipline, and long-term investment in agricultural innovation and renewable energy.

DN AGRAR GROUP S.A.

Sets Course for Main Market Upgrade and Announces Dividend Plans Following Biomethane Plant Launch

As part of this evolution, the Company is targeting the introduction of dividend payments in 2027 or 2028, following the commencement of production at its biomethane plant.

Since its listing, DN AGRAR has demonstrated strong operational performance and scalable growth, solidifying its position as a market leader.

The upcoming launch of the biomethane plant contract, Straja farm, Compost factories and CUT 2 represents major milestones in the Company’s expansion strategy, contributing to long-term revenue stability and profitability.

With this foundation, the Board believes that a transition to the Main Market will enhance shareholder value, improve liquidity, and attract a broader investor base.

DN AGRAR is, above all, a growth company, built on innovation, strategic vision, sustainable approach, and disciplined execution.

Since our listing in 2022, we have kept our promises, tripled in size, and expanded our operations, capabilities, and impact in the agribusiness sector.

Upgrading to the Main Market is not just a recognition of our evolution, but a springboard for the next phase of scalable, sustainable growth. Our 2025-2030 Strategy, shaped not only around expanding our core dairy operations but also on the launch of entirely new business lines, will significantly diversify our revenue base and position DN AGRAR to more than double the EBITDA by 2030.

With new revenue streams such as biomethane production set to come in the next two years, we are committed to both reinvesting in accelerating our development and beginning to reward our shareholders, thus targeting dividend distributions starting in 2028.

This dual focus underscores our ambition to build a resilient, high-performance company that generates sustainable value for all stakeholders

Peter de Boer,

CEO & BoD Member

DN AGRAR Group

Strategic M&A in Dairy and Beyond

We are actively pursuing mergers and acquisitions (M&A) to accelerate growth, with a focus on acquiring high-potential dairy farms and expanding our footprint in the European market. Additionally, we are targeting strategic acquisitions in the vegetable and fruit sectors, diversifying our portfolio and opening up new markets to fuel additional revenue growth.

Why invest in DN AGRAR?

High-Return Growth Strategy: DN AGRAR’s Strategy 2025-2030 presents exceptional investment opportunities across a diversified range of agricultural sectors. Our focus on sustainability, technological innovation, and strategic M&A ensures a clear path to strong, long-term financial performance.

Market Leadership in Dairy and Beyond: With a commitment to enhancing our dairy operations and expanding into value-added products, DN AGRAR is well-positioned to become a leader in the dairy and agricultural industries, generating superior margins and establishing a strong market presence.

Market Leadership in Dairy and Beyond: With a commitment to enhancing our dairy operations and expanding into value-added products, DN AGRAR is well-positioned to become a leader in the dairy and agricultural industries, generating superior margins and establishing a strong market presence.

Sustainability and Efficiency: Through investments in solar energy, wheatgrass production, composting, and biomethanization, DN AGRAR is pioneering a more sustainable and cost-effective model that will reduce operational risks and maximize profits.

Geographic Expansion: The Group’s expansion into key European markets like Hungary, Poland, and Bulgaria offers a high-growth opportunity to scale our operations, increase revenue, and capture new market share in some of the most dynamic agricultural regions

Diversified Investment Opportunities: DN AGRAR’s diversified investment approach, including M&A activity, strategic farm expansions, and entry into the fruit and vegetable sectors, offers investors a broad spectrum of high-return opportunities across multiple industries.

Industrial Clusters 2025-2027

decision 2027

This initiative aims to enhance the company’s agri-food production by integrating key elements such as solar energy, organic fertilizers, and advanced agricultural practices into a unified cluster model.

By leveraging synergies between solar energy, organic fertilizer production, agricultural land, and food processing, DN AGRAR Group can capitalize on the key benefits of industrial clustering, which can lead to both economic growth and environmental sustainability.

The main advantages of developing industrial clusters for raw material production in Romania:

1. Economies of Scale

Cost Reduction through Shared Resources

Bulk Purchasing

Shared Innovation

3. Improved Innovation and Knowledge Sharing

Cross-Sector Collaboration

Innovation Hubs

Technological Transfer

5. Job Creation and Economic Growth

Local Employment Opportunities

Attracting Investment

Economic Diversification

7. Resilience to External Shocks

Supply Chain Stability

Risk Mitigation

2. Increased Productivity and Efficiency

Streamlined Operations

Optimized Resource Use

Just-in-Time Production

4. Enhanced Market Access and Competitive Advantage

Stronger Market Presence

Better Access to Regional and Global Markets

Sustainability as a Competitive Advantage

6. Sustainability and Environmental Impact

Reduced Environmental Footprint

Resource Efficiency

Circular Economy Model

8. Cluster Development as a Long-Term Strategy

Community and Regional Development

Scaling Opportunities

General

information

Address:

Piața Iuliu Maniu Street, No. 1,

Alba-Iulia County, Romania

Phone:

+40 258 818 114

+40 258 818 115

Email:

office@dn-agrar.eu

How to get

in touch with us?

Peter de Boer, CEO & BoD Member

DN AGRAR Group

investors@dn-agrar.eu

NEWSLETTER

Subscribe

Get our latest news, results and reports in your inbox.

By subscribing you agree to the Terms & Conditions and the Privacy Policy. This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply. Supplied by © Euroland.com: Terms of Service, Privacy Policy, Cookie Policy

Disclaimer

This presentation outlines DN AGRAR’s Strategic Vision for the period 2025-2030, including four financial scenarios intended to provide insight into the management team’s current outlook and ambitions for the company’s development.

The purpose of this strategic overview is to transparently communicate DN AGRAR’s medium-to-long-term direction, priorities, and investment considerations, as envisioned by the management team at the time of presentation.

It is important to note that this strategic plan, including the financial scenarios and investment goals, does not constitute a commitment or guarantee that all objectives will be fully realized or implemented.

The strategy represents a forward-looking vision that is inherently subject to risks, uncertainties, and evolving market conditions.

Assumptions underpinning the scenarios may be impacted by a range of external factors, including but not limited to macroeconomic developments, agricultural market dynamics, climate conditions, political shifts, and legislative or regulatory changes in Romania and globally.

DN AGRAR is committed to maintaining an agile and adaptive strategic approach. The strategy will be reviewed on a regular basis and formally updated at least once per year to ensure alignment with emerging trends, stakeholder interests, and the broader operating environment.

We emphasize that the ongoing monitoring and refinement of our strategic direction is essential to safeguarding the long-term interests of our investors and all stakeholders, while striving to maximize sustainable value creation.

Investors are advised to interpret this document as a dynamic framework subject to ongoing evaluation rather than a definitive roadmap.